Ep.3 - The Third Hurdle to Homeownership in LA – Down Payment

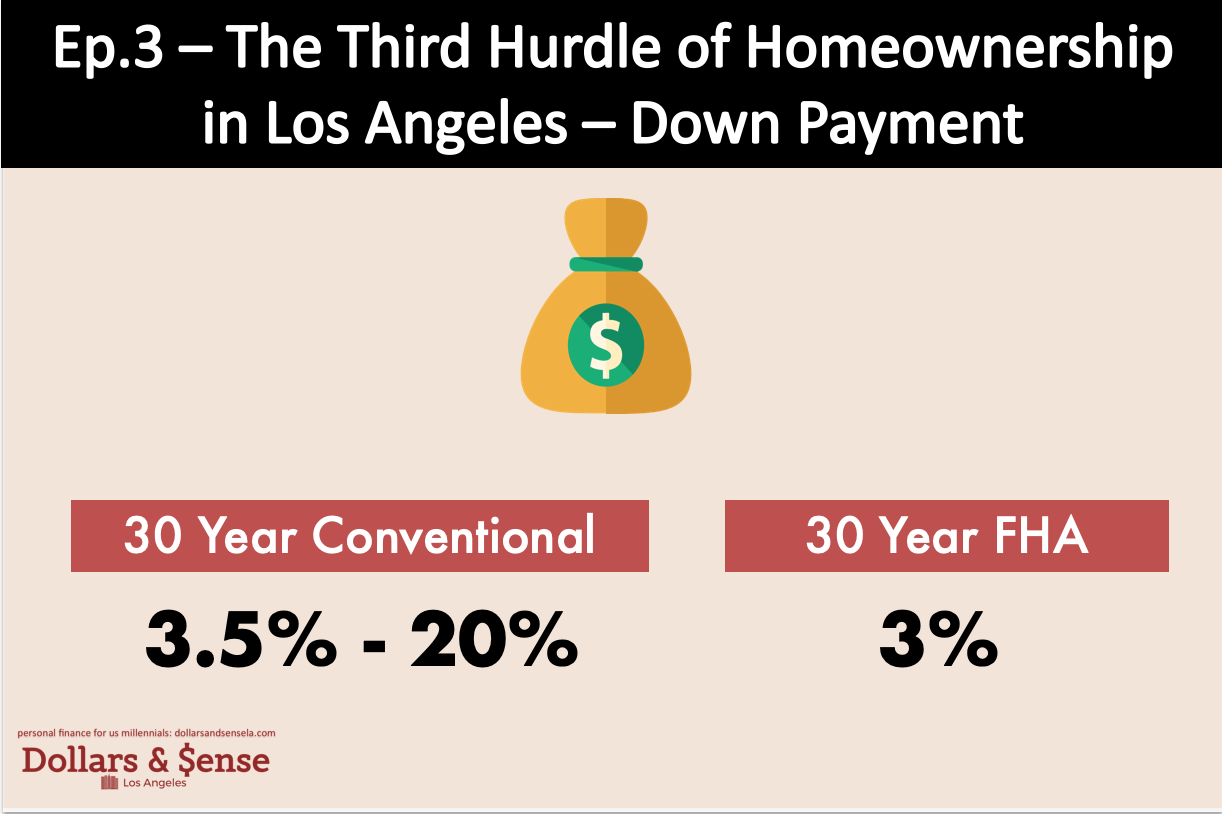

Hurdle #3: Down Payment - Save At Least $45k (for an FHA loan), Otherwise $55k

📸 IG handle: DollarSenseLA

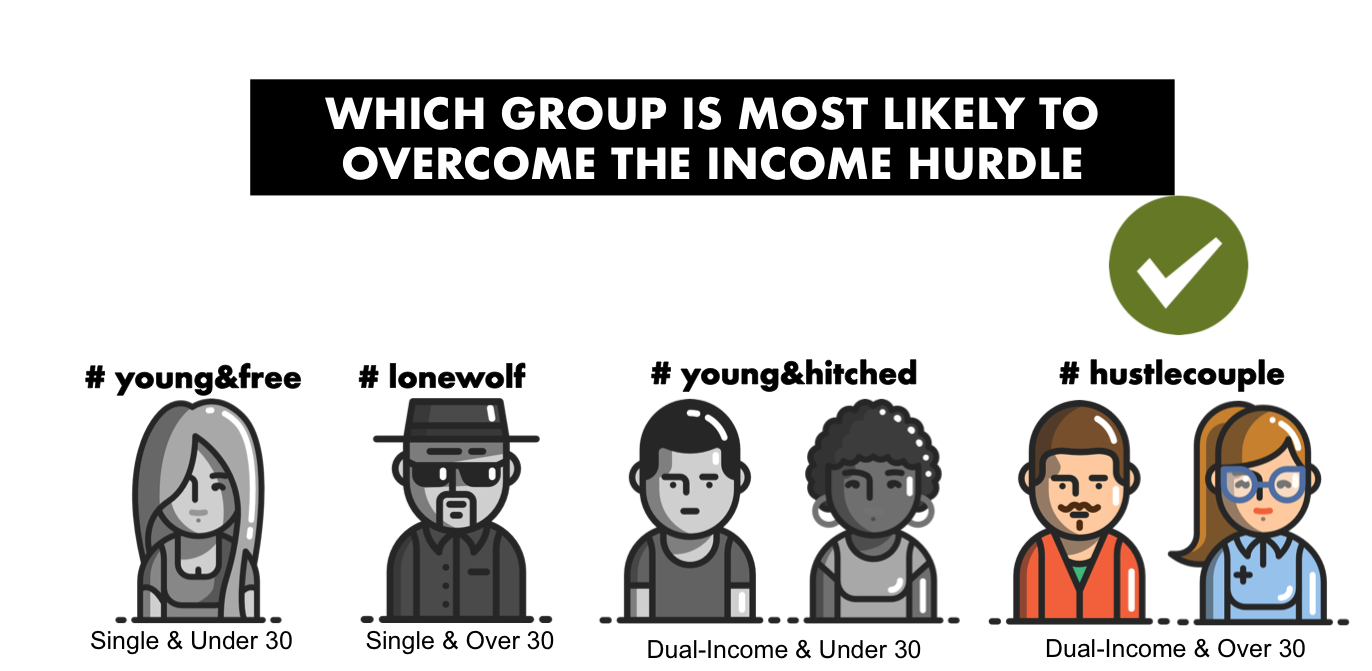

Having enough cash for a down payment is a huge challenge for most millennials, especially if you belong to #young&free, as you haven't have many years to save and you don't have a partner to pull in more savings together with. If you are a #hustlecouple, you are the most likely audience to be able to pull this off.

The traditional down payment amount is typically 20% of the house price, but the tradition does not stop you. For example, historically on a home of $600k, you need $120k in cash. That number is before factoring in additional closing costs. For most, this astronomical six figure number nails a death note to our hopes and dreams.

5 is the new 20. Fortunately, Freddie Mac and Fannie Mae have invented mortgage products that made credit more accessible. In 2017, if you choose a conventional loan, you can put down as little as 5%. On the other hand, if you choose an FHA loan, you may put down as little as 3.5%. At this point, you may be thinking, an $800k home on the Westside only requires $28,000. All of a sudden, it seems within reach. HOLD-YOUR-THOUGHT!

However, You CAN'T purchase an $800k house with a 5% down, because when you put in so little for a down payment, there is a cap on the amount of loan you can borrow. The cap is called a conforming loan limit, which is $636,150 in 2017 in Los Angeles. Simply put, if you would like to take advantage of low down payment options with either conventional (5% down) or FHA (3.5% down), you can only borrow as much as $636k.

How much house can you afford if you pick the best combo of a minimum down payment (5%) and a maximum loan ($636k)?

$670k!

What happens if you choose to borrow more than $636,150? You will need to come up with a minimum down payment of 15%, a whooping +$105k on a house of $700k, plus another $21k to $35k for closing costs. In total, that comes out to be at least $120k. Some older millennials (#hustlecouple or #lonewolf) may be able to swing it. But let's be real, for most, it is simply not an option yet.

Let’s face it, it takes years to save six figures in LA, no matter your income. Realistically, if you are buying your first home, you are probably going with one of the low down payment options: a 30-year fixed conventional loan or an FHA loan. Now let’s get into some real life scenarios.

1) Scenario 1 - 5% down payment with a 30-year fixed rate conventional loan at the max loan amount of $636,150

2) Scenario 2 - 3.5% down payment with an FHA loan at the max loan amount of $636,150

3) Scenario 3 - 15% down with a conventional on the Westside with a purchase price of $800,000 (believe it or not, it is a rare find at this price)

*In all scenarios, I am making low-end assumptions on closing costs, as it typically ranges between 3% and 5% of house purchase price.

Scenario 1 is the best option for you if you have very little cash (less than 5%) OR you don’t have a credit score of 720 or higher.

Getting an FHA loan is the fastest way a typical millennial can buy a house at a young age. However, there are two drawbacks, which will make your monthly payment higher than a conventional loan. The first drawback is the upfront MIP, which is a one-time expense of 1.75% of your loan amount. Typically , it gets folded into the total amount of your loan. The second drawback is the monthly MIP, the equivalent of Private Mortgage Insurance (PMI) for an FHA loan. With a 3.5% down payment, you are charged an additional .85% interest rate, much higher than the alternative PMI from a conventional loan. The worst part about the monthly MIP? Unlike a conventional loan, it stays with you for the entire 30 years.

With all the drawbacks, could it still be a good option for a person who wants to ride the wave of a housing boom? Yes!! An FHA loan is an excellent option because you don't need much cash upfront and you can always re-finance it to a conventional loan at a later time. At what interest rate though? That's any man's guess.

Scenario 2 is the best option if you have enough cash to cover at least a 5% down payment.

Compared to the FHA program, you will save on monthly payments because 1) you have a slightly smaller loan base, 2) you pay less on the PMI. The drawback is you need to have more cash upfront. In our scenario, you need at least $55k to cover the 5% down payment and the closing costs. In reality, you will need another $10k to $20k to cover house furnishing afterwards.

Scenario 3 is purely to show you it is NOT a real option.

As a millennial, unless you are a ultra-saver or you are borrowing from your family, it is nearly impossible to come up with $144k in cash in order to purchase a house of $800k. If you truly treat homeownership in LA as a personal priority, you need to be okay with leaving the Westside. Simple as that.

What’s Next?

If you are a typical millennial in LA, you probably have student debt and/or a car payment, which leads to the last and biggest hurdle of all, Debt to Income Ratio! Caution ahead. If you want to find out what it is and how it impacts you, stayed tuned to next week's episode.