Ep.23 - 4 Hacks to Become More Financially Literate

Before we get into the hacks, take this 3-question test to see if you are financially literate. For full transparency, I didn't create the test. Olivia Mitchell, a Wharton School professor, created it a decade ago. You can check your answers below the first GIF. Don't cheat, take the test and THEN scroll down!

QUESTION 1

Suppose you had $100 in a savings account and the interest rate was 2% per year. After five years, how much do you think you would have in the account if you left the money to grow?

(A) More than $102. (B) Exactly $102. (C) Less than $102.

QUESTION 2

Imagine that the interest rate on your savings account was 1% per year and inflation was 2% per year. After one year, how much would you be able to buy with the money in this account?

(A) More than today. (B) Exactly the same. (C) Less than today.

QUESTION 3

Please tell me whether this statement is true or false: Buying a single company's stock usually provides a safer return than a stock mutual fund.

A) True B) False

The answers are A), C), B). Did you get them right? If you did not, you are not alone. Over half of Americans with a college degree did not get them right. Over 80% of Americans with only a high school education did not get them right. It's okay. Here are 4 hacks to get better at it.

Hack 1: Understand the Power of Compound Interest (and Patience)

Warren Buffet, the 2nd richest man in the world famously said the single most important factor behind his investing success is "compound interest." Similarly, Albert Einstein called compound interest the 8th wonder of the world.

How does compound interest work to make us richer or poorer? Look at the graph below. Compound interest creates insane growth of wealth OR debt over time. The longer it is, the more exponential wealth or debt you will have.

You may not understand it fully, but if you are making payments to your credit card debt, auto loan, auto lease, mortgage or student debt, you are already living in the world of compound interest.

Hack 2: ALWAYS ALWAYS! Pay More Than the Minimum Amount On Your Debt

In the world of debt, compound interest is bad news for you. Always pay more than the minimum payment, when it comes to credit card debt, auto loan, student debt, and mortgage.

Why? Let's take student debt as an example. If you have $20,000 in student debt (which is 1/3 below the national average) with 5% compound interest, you are paying $212 a month over the next 10 years.

Because it is a compound interest, you are NOT paying $1,000 ($20,000 * 5%) in interest. Instead, you will end up paying $5,461 in interest at the end of your 10th year.

What's the smart move then? Pay more each month! If you pay $500 instead of $212, you will not only pay $3,500 less, but you will also be debt free in 4 years instead of 10. Here is a prepayment calculator you should use to see how much you can save by paying more in your own case.

Hack 3: Contribute to the max % of 401k your company matches

As a millennial, your best advantages are compound interest and time. Because you are young, you have more time to grow your wealth with compound interest.

You should always contribute to the max percentage of 401k your company offers, so you don't leave money on the table. I dedicated a whole episode in episode 31 on this topic. You can get a more detailed explanation there.

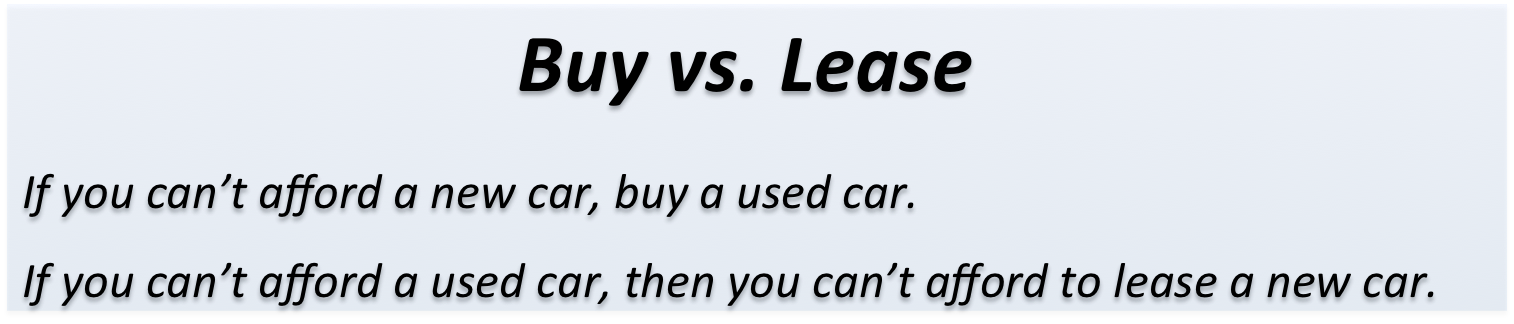

Hack 4: Never Lease A Car Unless You Are a Baller

Leasing a car is like renting a luxury apartment, you spend a lot of money and you will have nothing to show at the end of it. You can certainly do it, if you are a baller, who actually has money to burn.

In 99% of the cases, compared to leasing, it is cheaper to buy the car if you can stay with it for 5+ year.

In 100% of the cases, compared to leasing, it is cheaper to buy a used version of the car that's 1 or 2 years old. Why? A car typically loses 10% of its value after the 1st year, and 15% to 20% after year 2.

I'm gonna leave you with a piece of advice I believe in myself on your next car buying.

I hope you enjoyed the article. Follow me on Instagram: dollars_and_sense_la.