Ep.84- How to Pick a Good Health Insurance Plan

📸 IG handle: DollarSenseLA

Read Time: 3 Minutes

A GUIDE FOR CORPORATE EMPLOYEES

This guide on how to pick a good health plan is only beneficial for people who have access to health insurance through their jobs, not for the self-employed. Though I won’t be able to tell you explicitly which one is the best for you, this framework will help you understand your health plan in simple terms, thus making an informed decision for your upcoming enrollment.

THE THREE PILLARS OF A GOOD HEALTH INSURANCE PLAN

A good health insurance plan has three major pillars. It fits your personal needs, provides excellent benefits, and it should be affordable. Your decision tree should be in this order.

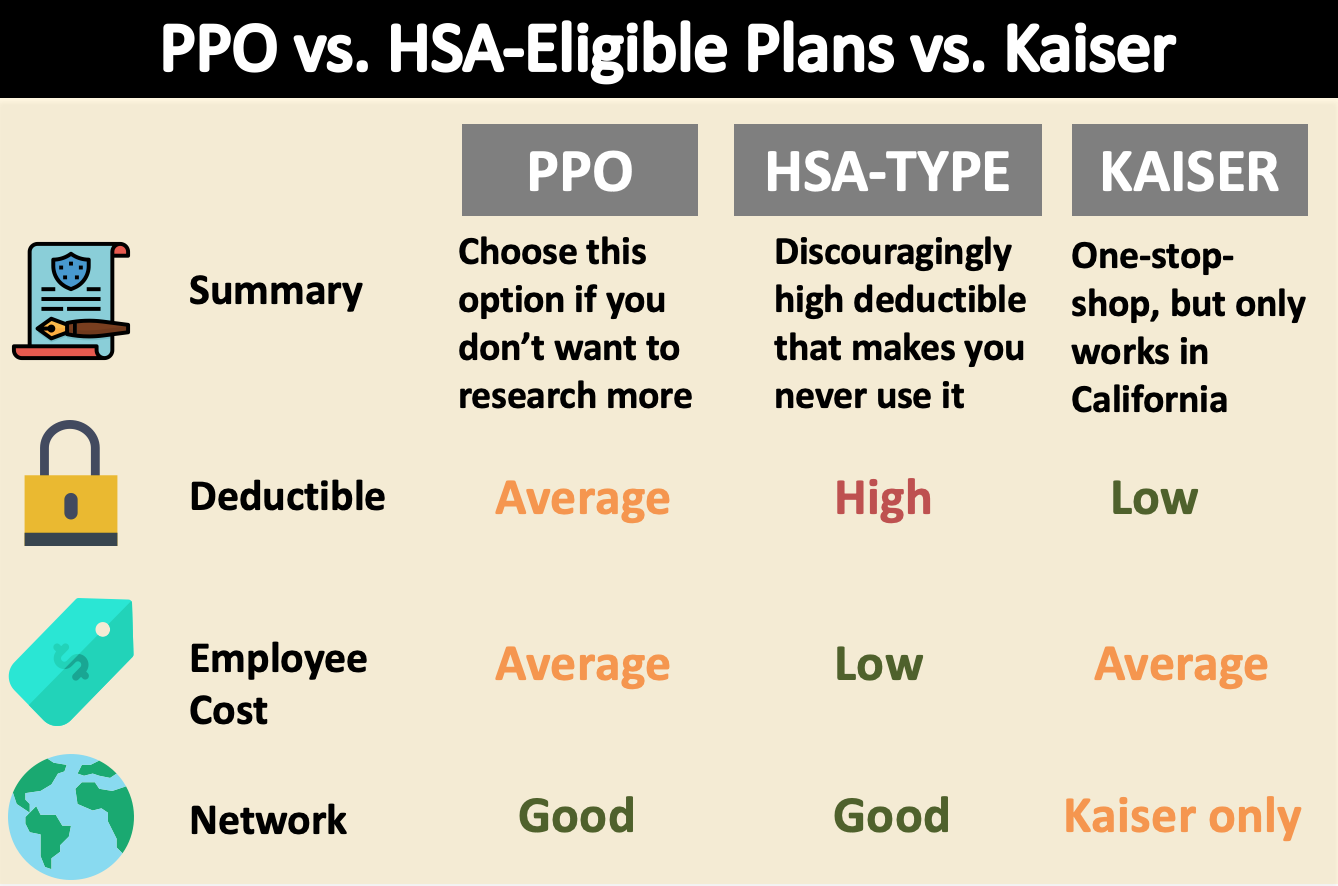

First, you need to understand your own needs and choose a plan type. The three major types are PPO, or HSA-eligible plans, or HMO plans (such as Kaiser).

A PPO is a large group of member hospitals and healthcare providers all over the country. An HMO is a limited set of specific hospitals and healthcare providers. An HSA eligible plan could use either network.

To do so, ask yourself these questions. Do you need a wide network coverage because you travel a lot? Do you only need insurance for accidental emergencies only because you are young and healthy? Do you prefer to go to one convenient place to take care of all your medical needs? These questions will help you determine what type of plan you need. For the vast majority, a PPO plan is the way to go.

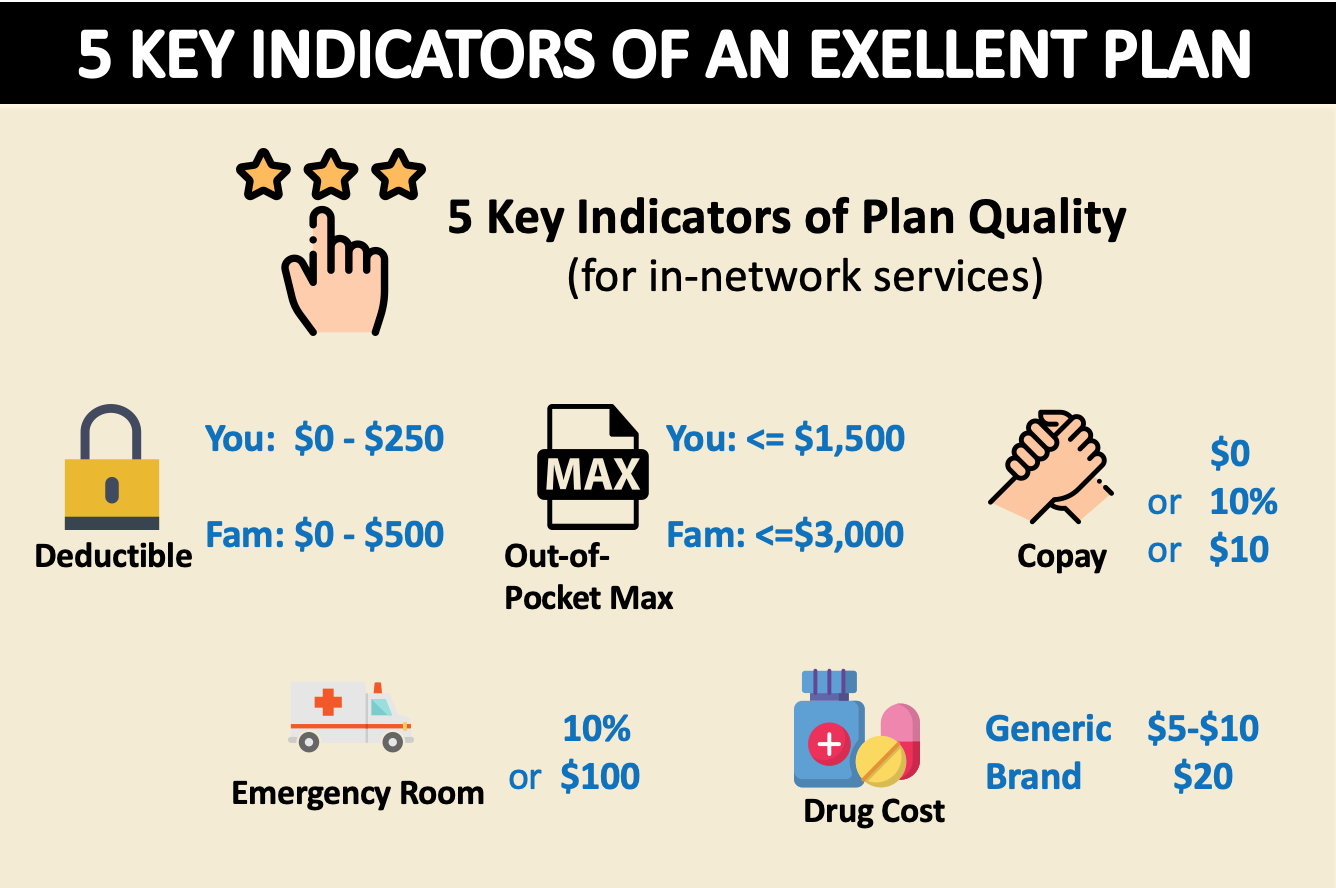

Once you choose a plan type based on your personal needs, you need to check 5 areas to understand the quality of the plan, whether if it’s great or just barebone. These five areas are deductible, out-of-pocket maximum, copay, ER visit, and prescription drug cost.

Lastly, you need to evaluate how much is your employee contribution. Typically, when a health plan has rich features and excellent benefits, it costs more, thus making your employee contribution higher. However, it is not always the case, because your employer may heavily subsidize it, so your portion can be quite low.

STEP 1: PICK A PLAN TYPE

The most common options are PPO, HSA-eligible Plans, and HMO. For HMO, I am going to use Kaiser, the biggest HMO in California, as a proxy.

A PPO is typically the most common and most balanced plan.

What is it : A PPO is large network of healthcare providers you can choose for your medical care. A PPO plan’s key strength is that it has the widest selection of doctors in the network. In other words, you have options no matter you are in Kansas or California. This plan type typically has average to good benefits at a reasonable cost, thus making it a mainstream option.

Who is it good for: It’s good for almost everyone, but it is especially a good option for people who travel a lot because they need a wide network of coverage.

An HSA-eligible plan can be a PPO or an HMO plan. This has a high deductible. It’s popular among startups because they are cheaper.

What is it : . With an HSA-eligible health plan, you can contribute pre-tax money to pay for your health expenses. An HSA account is only available on plans with high deductibles. In reality, the deductible on all HSA plans is at least $1,350 for one person, and $2,700 for a family. With this type of plan, an employer sometimes contributes some amount to an HSA account to help you pay for the high deductible. This type of plan is typically cheaper than a regular PPO. Since it’s cheap, an employee’s monthly contribution can be as low as $0. Though it’s cheap to have, it is not cheap to use.

Who is it good for: Because the deductible is very high, it is very discouraging for most people actually to use their health insurance. For this reason, it may only be good for people want to have insurance, but don’t want to use it.

Kaiser is the largest HMO plan provider in California. I am using Kaiser as an example for all HMO as I am most familiar with it.

What is it : An HMO is a limited network of healthcare providers Kaise, the biggest HMO providers in California, is a one-stop-shop. You basically go through Kaiser for everything, from your flu shots, to your check-ups, to your prescription drugs, to your ER visits. It’s quite convenient if there’s one near you. And it is typically an affordable option as well.

Who is it good for: Kaiser can be good for people who want simplicity and convenience with all their healthcare needs. But if you injure yourself outside of California, you are out of luck.

STEP 2: CHECK THE QUALITY OF THE PLAN

Health insurance documents are lengthy and complicated to understand. Don’t worry. In order to evaluate if one plan is better than another, all you need to know are these five key areas: deductible, out-of-pocket max, copay, ER visit, and prescription drug cost.

Deductible

Your deductible is the amount you need to pay out of pocket before your health plan benefits kick in. The best plans I have seen have deductibles between none and $250 for one person, and a maximum of $500 for a family.

Out-of-pocket max

Your out-of-pocket max is the maximum amount you pay in a calendar year regardless of how much health services you use . Your health plan picks up the tab after your out-of-pocket is met. This benefit protects you financially during costly accidents. The best plans I have seen have an out-of-pocket max of $1,500 for one person and $3,000 for a family.

Copay

Your copay is the amount you pay every time you use a medical service (outside of preventative care). Your plan is excellent if it has $0, $10, or 10%.

ER visit

An ER visit can be very expensive, as an ambulance ride can cost upwards of $1,000. Your plan is excellent if your ER visit is either $100 or 10%.

Prescription drug cost

Prescription drugs can cost a lot. Your plan is excellent if your copay is between $5 and $10 on generic drugs, $20 on preferred brands.

STEP 3: WHAT IS A GOOD AMOUNT ON EMPLOYEE CONTRIBUTION

My experiences do not capture everything. However, I have evaluated half a dozen insurance plans with four different companies in the last 7 years. These experiences helped me understand what is a good price as far as employee contribution goes.

You can use the matrix to understand based on your family size. As an individual person, I’ve found that the best insurance plan costs an employee $0. However, if your plan costs less than $100/month, it is still really good.

The cost rises quite significantly when you add a spouse, or your whole family with kids. I have yet to see a plan with an employee contribution of $0 for the whole family.

WHAT WOULD I PICK

In order to pick a good healthcare plan that’s right for you. You should start with the type of health plan, then check its quality, lastly, evaluate its price. You should NOT start with the price, because if you do, you may end up the cheapest one in terms of monthly contribution, but it may cost you a lot more down the road when you actually need to use it.

Personally, I would not go with an HSA-eligible plan, because the deductible is so high it actually discourages me from going to the doctors. A Kaiser plan can be an affordable and good-quality option, but you better not travel outside of California much. For the vast majority of us, I would stick with a standard PPO, and find a balance between quality and price that fits in your budget.