Ep.90- Why We Pay Less on Marginal Tax at $150K Than We Do at $50K

📸 IG handle: DollarSenseLA

THE PERCEPTION OF OUR PROGRESSIVE TAX SYSTEM is not entirely accurate

In theory, we have a progressive tax system in the U.S, meaning the more money we make, the higher percentage of taxes we pay. Here’s an example to illustrate this idea of a progressive tax. If you make $150k a year, you should pay more taxes on your second $50k (maybe 30%) than your first $50k (maybe 20%), again you should also pay more taxes on your 3rd $50k (maybe 40%) than your second $50k.

If we draw it out, it may look something like the chart on top. However, did you know it’s actually not true in real life? As a single person, you actually pay less in marginal taxes at $150K(34.8% than at $50K (36.7%). You are probably thinking WHY?!?!?! Well, we will get there, but you first need to understand the 5 components of income taxes we pay in the U.S.

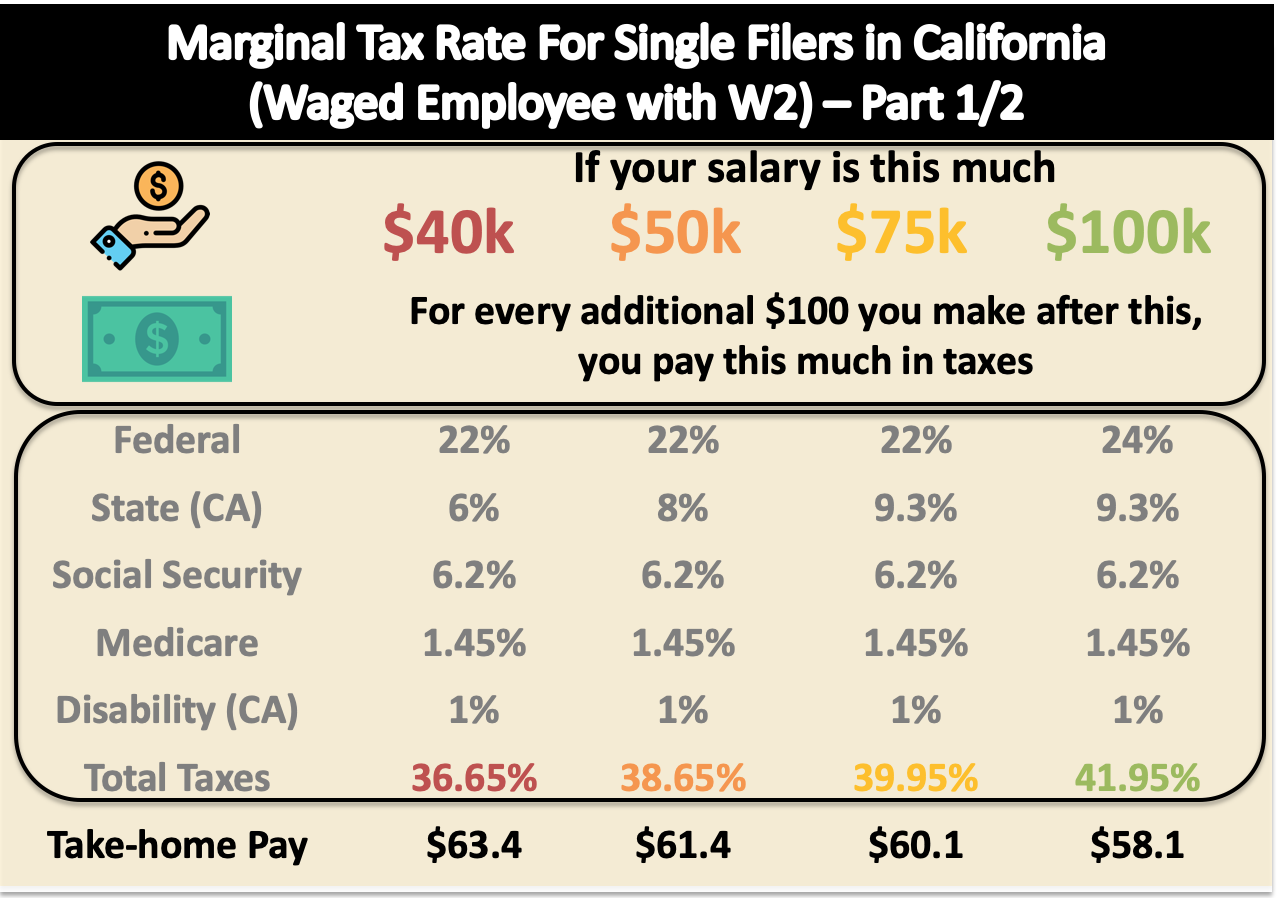

WHAT ARE ALL THE TAXES WE PAY

We pay 4 or 5 different taxes out of our paychecks. They are federal income tax, state income tax, social security tax, medicare tax, and sometimes a state-specific tax, such as the 1% disability tax in California.

Both federal and California income taxes are progressive. Here are the actual numbers from 2019 to visually illustrate how people pay a higher percentage as they make more. At the same time, some states, such as New Hampshire, don’t have an income tax, and other states, such as Illinois, have a flat income tax.

A CAP ON SOCIAL SECURITY IS THE REASON YOU PAY LESS after $133k

Social security tax is not a progressive tax. Each person only pays social security tax (6.2% for W-2 wage earners and 12.4% for self-employed) up to $132,900. After this amount, the marginal tax rate for social security goes literally to 0. This is the reason people begin to pay less in taxes after reaching $133K in 2019.

However, this tax reduction does not last forever, because, at some point, when you make more money, your federal income tax jumps from 24% to 32%. At that point, it will entirely erase the tax relief from the absence of a social security tax. As a single filer, you hit the wall at $173K, after which, your taxes rise even higher. $173K is the magic number, because $160,725 is the income level that bumps you to a 32% federal tax. But wait, everyone gets to take a $12,200 standard deduction, which means, you need to make $173k ($160,725 + $12,200), in order to actually get taxed at 32%.

As a result, as a single filer, your marginal tax is unusually low between $133K and $173K.

TAKEAWAYS

The information from this article is mostly knowledge for knowledge’s sake, where there isn’t any direct action you can take immediately. It’s more to illustrate our tax system, in a way, still favors rich, though probably not intended.