Ep.31 - SOML: How Much Do I Put Into the 401K? (3 Minute Read)

Read Time: 3 Minutes

Have you ever wondered how much you should contribute to your 401k account? If so, you have landed on the right page. I understand it's a highly personal matter, so I'm not going to tell you what to do. Instead, I will show you what I do and explain why I do it. You can then take it and cater it to your own needs.

HOW MUCH DO I CONTRIBUTE?

I contribute to the highest percentage amount the company matches, because that's free money and it's the highest return you can get on your dollars! Let me explain in two examples.

Example 1 - 8% match with 50 cents on the dollar: If this were the case, I would contribute 8% of my pay to the 401k account, because I'm getting an additional 4% (.5 x 8%) matched to my 8% contribution. In other words, you're getting a 50% return on your investment already. You can't beat that on the stock market.

Example 2 - 3% match with 25 cents on the dollar: If this were the case, I would contribute only 3%, because the company will not match anything above the 3% contribution. In this case, I get 0.75% (3% x 0.25) on top of my 3% contribution, which totals 3.75%. In other words, I am getting a 25% return on my 3% investment. That's still really good.

WHY DON'T I CONTRIBUTE MORE FOR THE TAX BENEFIT?

Reason #1 - Future Uncertainty: I am 28 years old. I have no idea what the tax rate will be when I'm 60 to withdraw from my 401k. Any 401k contribution is tax-exempt at the time you contribute. BUT, that doesn't mean it's tax free. Uncle Sam wants his share later on. When you withdraw at age 60, you will have to pay tax on it.

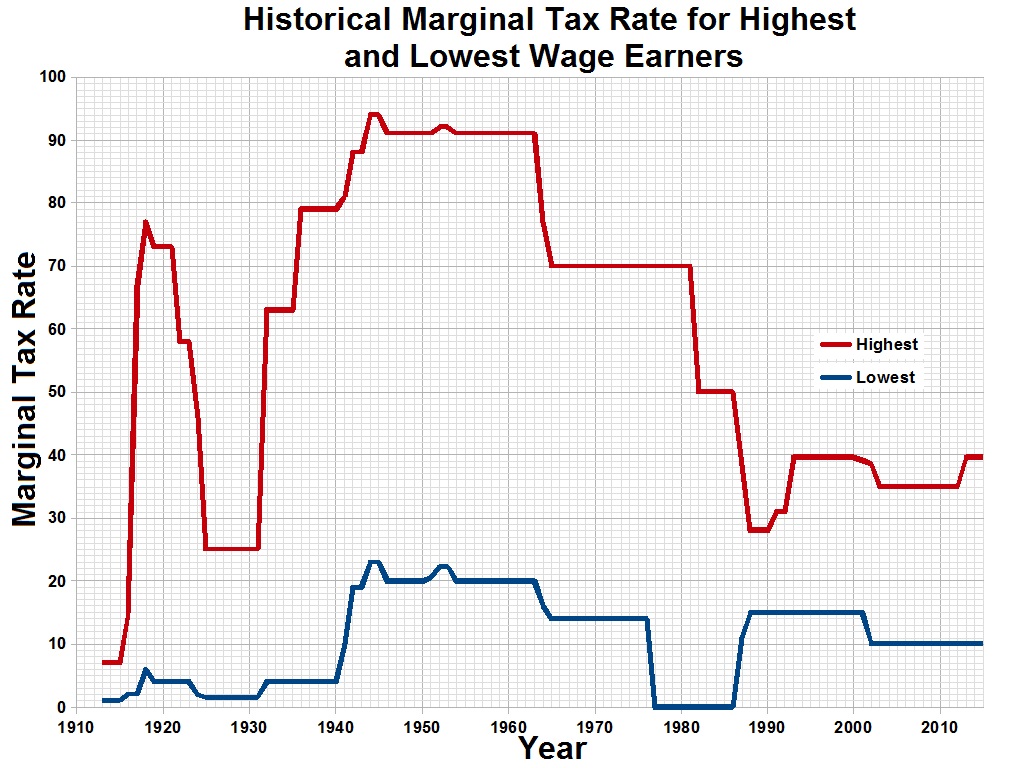

The current federal tax rate is quite low by historical standards. It is very likely the future rates will be higher. Therefore, it is very likely I would be paying more taxes when I withdraw. Why would I do that?

Reason #2 - Other Priorities That Require Capital: Personally, I had and still have other priorities in life that require capital (money). For example, in the last two years alone, I've had many life priorities, including paying off all my debt, paying for a wedding, and saving for a down payment for a house. They all mattered to me more than saving for my retirement 30 years down the road.

UNDER WHAT CIRCUMSTANCES WOULD I CONTRIBUTE MORE?

I would contribute more if I have extra savings in my budget and I don't have any plans to use that money for any future project.

Personally, I don't expect that to be any time soon, as I have better investment opportunities in mind that are more liquid than putting money away in a 401k account. Remember, once you put it away in a 401k account, it's very hard to take it out without paying an extra penalty of an additional 10% on top of the standard taxes.

tl;dr : 401k contribution is a personal decision. What I do is contribute to the max % amount of what the employer offers to match, and no more, because 1) I have no idea what the future tax rate will be when I'm 60, and 2) I want to use extra savings to invest in other more flexible opportunities.