Ep.30 - SOML: How I Apply the Concept of "Leverage" to Build Wealth

I'm a regular millennial just like you. I drink too much coffee, play too many video games, and watch too much Netflix. When it comes to building wealth, I don't have hundreds of thousands of dollars lying around. But I understand how to amplify wealth-building through a simple but less discussed technique -- leverage.

Caution: you should only leverage for investment purposes, and you should only invest in things you FULLY understand yourself!!!

WHAT DO I MEAN BY "LEVERAGE"?

It's quite simple. Leverage is the financial strategy of using borrowed money. For example, if you have $100, and you convince your friends to give you another $900 for whatever reason, you have just leveraged 90% of the total fund, with 10% of your own equity (equity = your own money).

WHAT DOES LEVERAGING LOOK LIKE IN REAL LIFE?

In order to leverage, you have to borrow money. Simply put, every time you spend money you don't yet have, you are leveraging. This means using credit cards, student loans, auto loans, mortgages, personal loans, borrowing from family, etc. For most people, the biggest leverage comes from the mortgage. And it's a good thing, as long as you don't buy a house too big for your budget.

HOW CAN LEVERAGING HELP BUILD WEALTH? - LET ME SHOW YOU

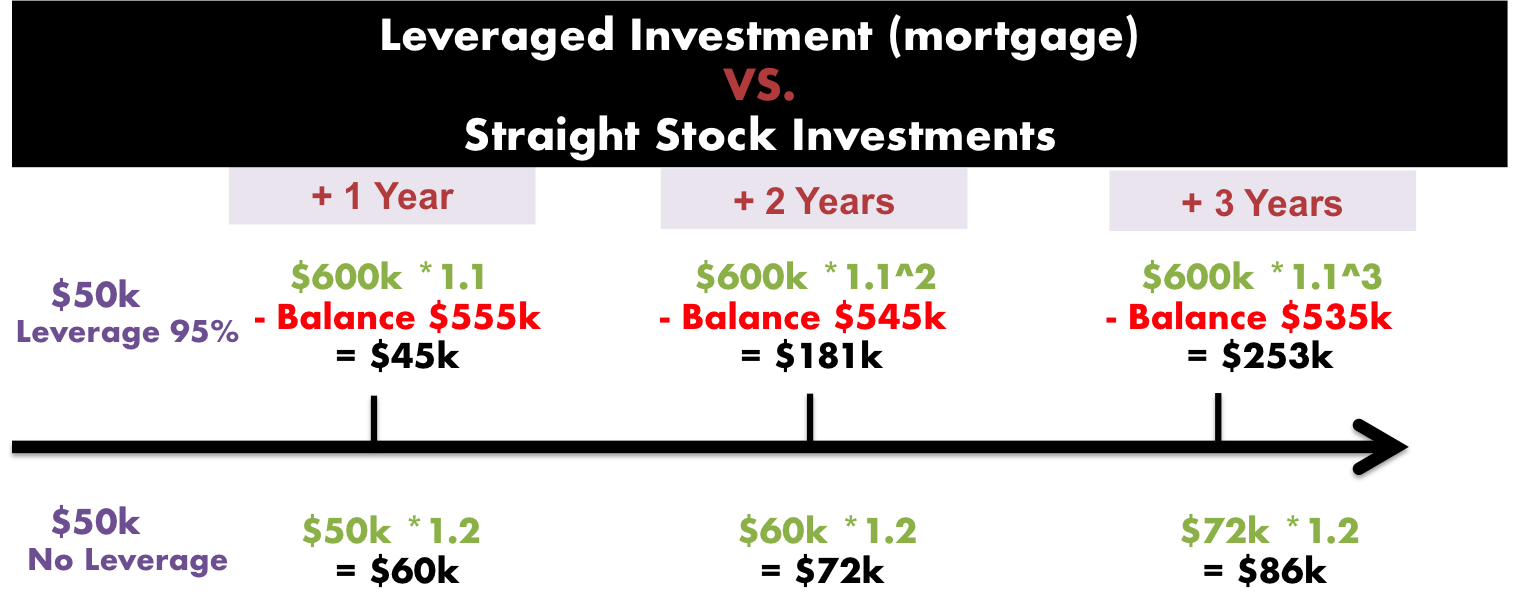

Let's say you have $50,000 saved up for investment purposes. You have two options: buy real estate or invest in stocks.

Option 1 - Leverage 95% at 10% annual growth: With $50k, you can buy a $600k house by putting 5% down ($30k), borrowing $570k, and still have enough for all the necessary closing costs. Let's say the house value is expected to grow at 10% a year for the next 3 years (hypothetically; the current LA market is growing more like 15%/yr). We can assume the interest rate is the current market rate at 4.25%, for this exercise.

Option 2 - plain $50k at 20% annual growth: You can invest in stocks which are expected to grow at twice the rate, 20% a year (hypothetical return).

From the graph below, you can see that the leveraged investment strategy outpaces the regular stock investments by $100k by the second year, because the the smaller growth of 10% is on top of a much larger base of $600k.

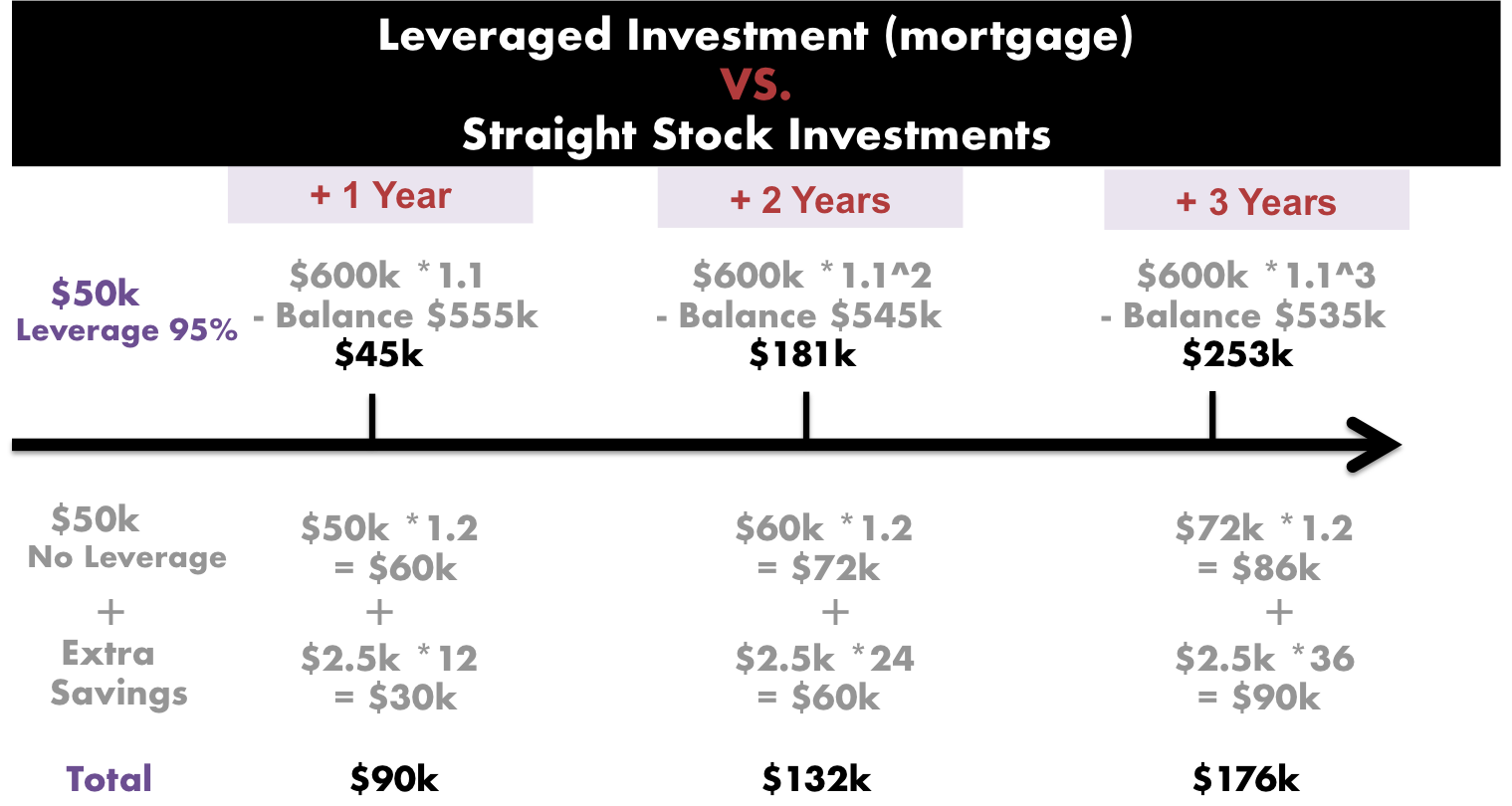

WELL, THE MORTGAGE COSTS MORE THAN RENT so WE SHOULD TAKE THAT INTO ACCOUNT

With a house of $600k, borrowing 95% at the interest rate of 4.25%. I will also factor in the 1.2% property tax, $1000 annual property insurance, and 0.5% PMI, the monthly cost is $3,723. Let's assume your rent in Los Angeles is $1,200, which is relatively low. You technically can save that extra $2,500 (technically $2,523), which is $30k/yr. Let's put that back in the math.

As you can see, even if you are a diligent saver, who rents cheap at $1,200/month, and saves $2,500/month, it is still much faster to build wealth through leverage. In fact, by the end of the third year, you will have $252k with the leveraged investment, almost $80k more than option 2, without leverage.

LEVERAGE ONLY FOR INVESTMENTS AND INVEST ONLY IN THINGS YOU FULLY UNDERSTAND

Mismanagement of leveraging can destroy you overnight. Just like how leveraging can help build wealth quickly, it can also destroy wealth quickly, if the returns are negative. We all know the story from the 2007 housing bubble. In my personal opinion, I think we are at least 5 years away from another housing bubble. It's strictly my personal opinion and I wrote about it in episode 14.

I hope you enjoyed the article. Follow me on Instagram: dollars_and_sense_la.