Ep.93- TIC (Tenancy in Common) is Homeownership Minus the Home

📸 IG handle: DollarSenseLA

UPDATED L.A. HOMES FOR ONLY $350K, BUT HOW🤔?

Starting in Q4 2019, I have noticed some insanely affordable homes on the market in Los Angeles. When I first found them, it didn’t make any sense whatsoever how cheap they were, especially because they were all fully updated yet under $400k. Here are two examples on the market as of 3/7/2020, with one on 2005 2nd Ave listed at $349k, and another one on 3036 S Virginia Rd #3 listed at $325k, for you to check out.

The even stranger thing is, if you search for 3036 S Virginia Rd #3 on the LA County assessor site, you wouldn’t be able to find it, because unit #3 actually DOES NOT exist. This essentially makes it a ghost property, which is the equivalent of Platform 9 3/4 in the housing market.

Well… Okay…it actually does exist, but under 3034 Virginia Rd, as one single complex, not individual condos. So what’s happening? The short answer is “Tenancy in Common”, aka TIC.

WHAT IS TENANCY IN COMMON?

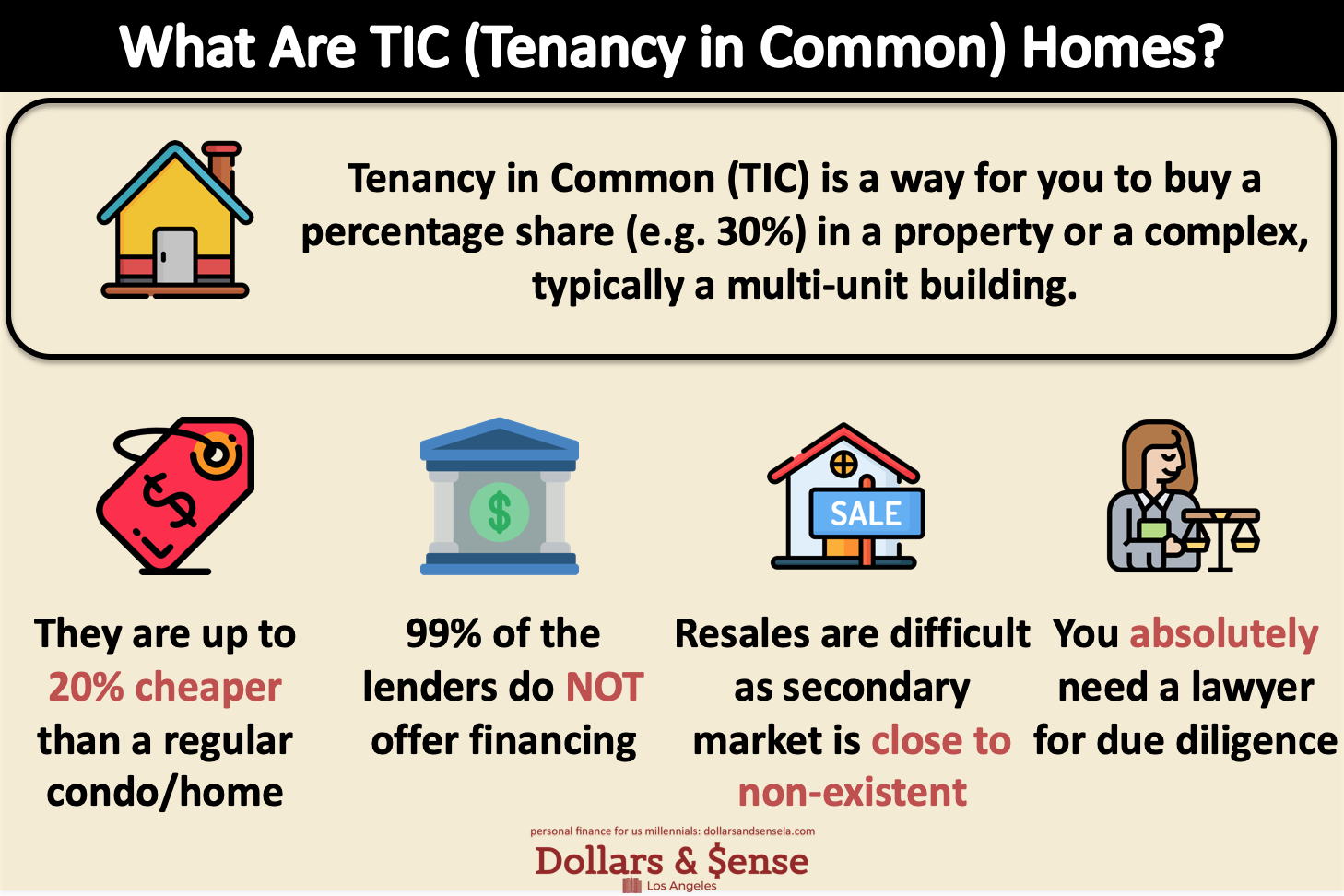

Tenancy in Common (TIC) is a way for you to buy a percentage share (e.g. 30%) in a property or a complex, typically a multi-unit building. In practice, it works somewhat similar to buying a unit in a condo complex, where each owner is responsible for their individual unit and has their own loan.

However, it is different from owning a condo in 3 major ways.

TIC is a private legal agreement, not a real estate type. Real estate types are things like single-family homes, condos, townhomes, multi-family homes and etc. TIC is not one of them.

With a TIC, there’s only 1 deed, 1 piece of land. You get a share of the complex, and it is recorded on the deed, this way, ”Person A owns 20% of a complex at this address”. It will NOT say “Person A owns unit 1 of the complex at this address”. Why? Because unit A does not technically exist. Instead, the “ownership” (more like occupancy) of all the properties is agreed upon privately with each other, not with the county government.

From the eye of the county, the whole complex is ONE property, even though each unit may be listed as its own property on Redfin. The most direct impact is property tax. The county collects it all together, but it’s up to each owner to divide up the share on taxes.

When you buy a unit, technically you do NOT own the individual unit. Instead, you own shares (like 25% or 50%) of the whole complex, which is then materially expressed as a unit in the complex based on this private agreement.

THIS TIME EXPLAINED IN LAYMAN’S TERMS

Do you remember those times in high school, when people fundraise by buying a 30 pack of chips from Costco for $15, and then sells them individually for $1 each to the students in between classes? This is exactly how TIC is playing out in Los Angeles. The original owner buys a multi-family complex and then sells each unit separately with a markup through TIC.

WHO BENEFITS FROM TIC

The person that benefits the most is the owner who bought the complex in the first place. Typically one has to buy/sell the whole complex altogether. However, with TIC, the owner is able to sell each unit in the complex, just like a high school student is able to sell each bag of chips individually with a markup.

You may ask, why doesn’t the person rent out the extra units instead? The answer is simple. The profit through TIC sales is not only much bigger, but also immediate. Substantial rental income through cash flow is a long game. But TIC sales in Los Angeles can help you make hundreds of thousands overnight.

A wilder manifest of a TIC is that I can technically convert my 2-car garage into a 700 square unit, and sell that through a TIC for $300K. Maybe an idea worth thinking… Second thought, I want my own space. So that’s a no for me.

SHOULD YOU BUY A TIC HOME?

I have not had the experience of buying a TIC yet, so here are strictly my opinions right now.

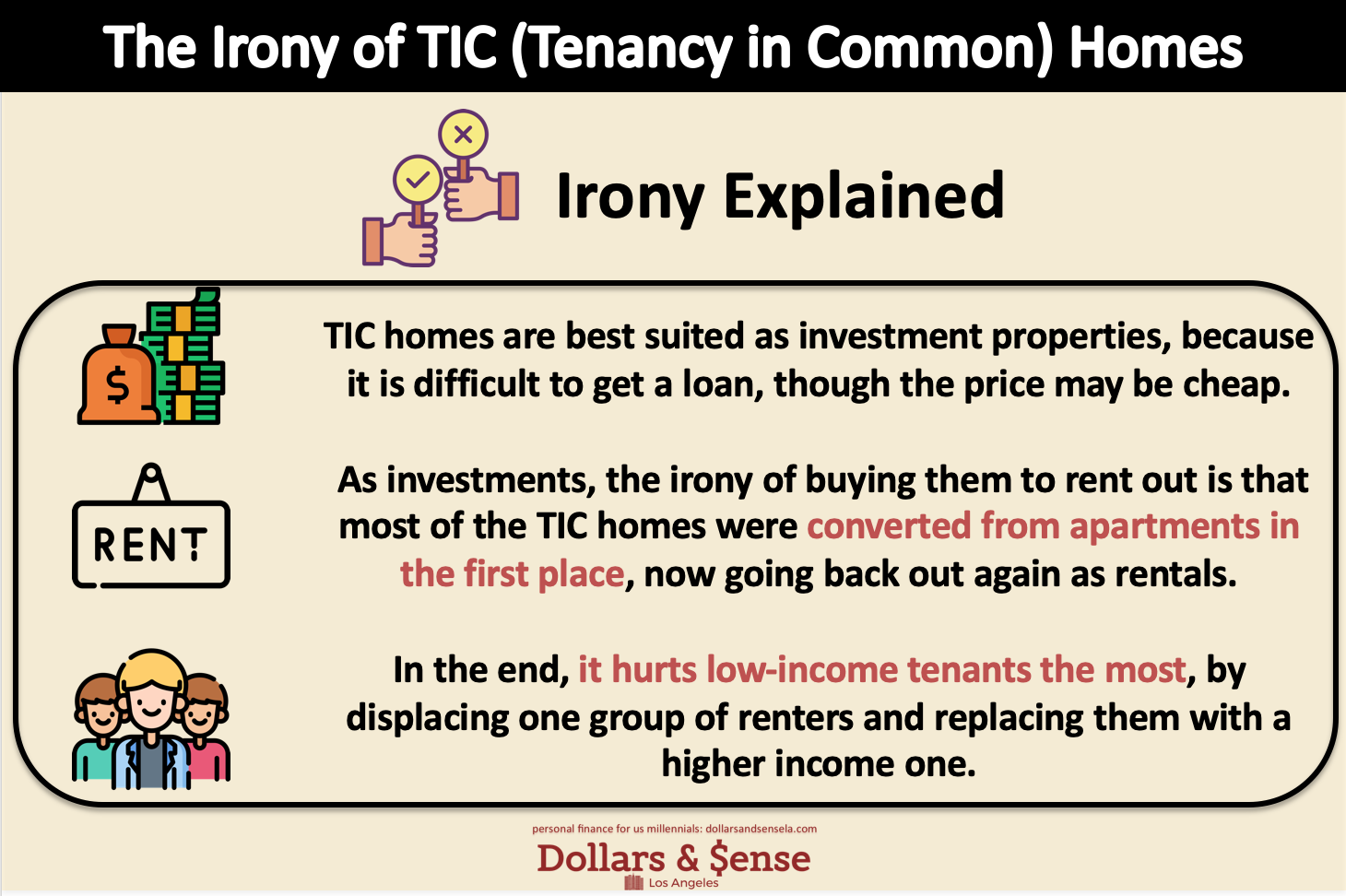

Since TIC homes are up to 20% cheaper than a comparable condo/home, I think TIC makes the most sense for potential investors who then rent it out, but not the general public that seeks homeownership.

There are so many potential complications that make it difficult for me to recommend a TIC home for the mass.

Difficult financing: 99% of the banks/credit unions will NOT provide financing. According to LA Curbed, only one bank, Sterling, provides financing for TIC homes in Los Angeles. This bank asks for a large down payment (at least 10%), higher APR (>4.4% as of 3.7.2020), at least 6 months of payments in savings, a low debt-to-income ratio of 33%, mandatory mortgage insurance, only adjustable-rate mortgages, not fixed. The tough requirements do not make senes for a first-time homeowner.

Non-existent secondary market: It could become difficult when you want to sell this property (technically shares) in the complex because there are so few homes being done this way, there isn’t really a secondary market for it at scale.

Need to involve lawyers: Typically, you don’t need a lawyer at all to buy and sell a home in Californa. However, since you are technically buying shares of a complex, not a specific unit, you need to spell it out explicitly your right to occupy a unit in a private legal document. As a result, you will need a lawyer for due diligence.

THE IRONY OF TIC HOMES

I am intrigued by the wave of TIC homes in Los Angeles. I don’t think this is a great option for first-time home buyers, because it asks for 20% down. Even it’s just a home of $350k, that’s still $70K and perhaps another $10k for closing costs. If a first-time home buyer had that much liquid cash ready for the first home, they probably can afford a condo or even a single-family home.

I can potentially see these TIC homes could make sense as investment properties. The irony of buying them as investment properties to rent out is that most of the TIC homes were converted from apartments in the first place, then transformed, and going back to serving as apartments, AGAIN, but with a higher rent, of course.

In the end, it benefits the original owner the most through a large windfall, and hurts the tenants the most, by displacing one group of renters and replacing them with a higher income one.