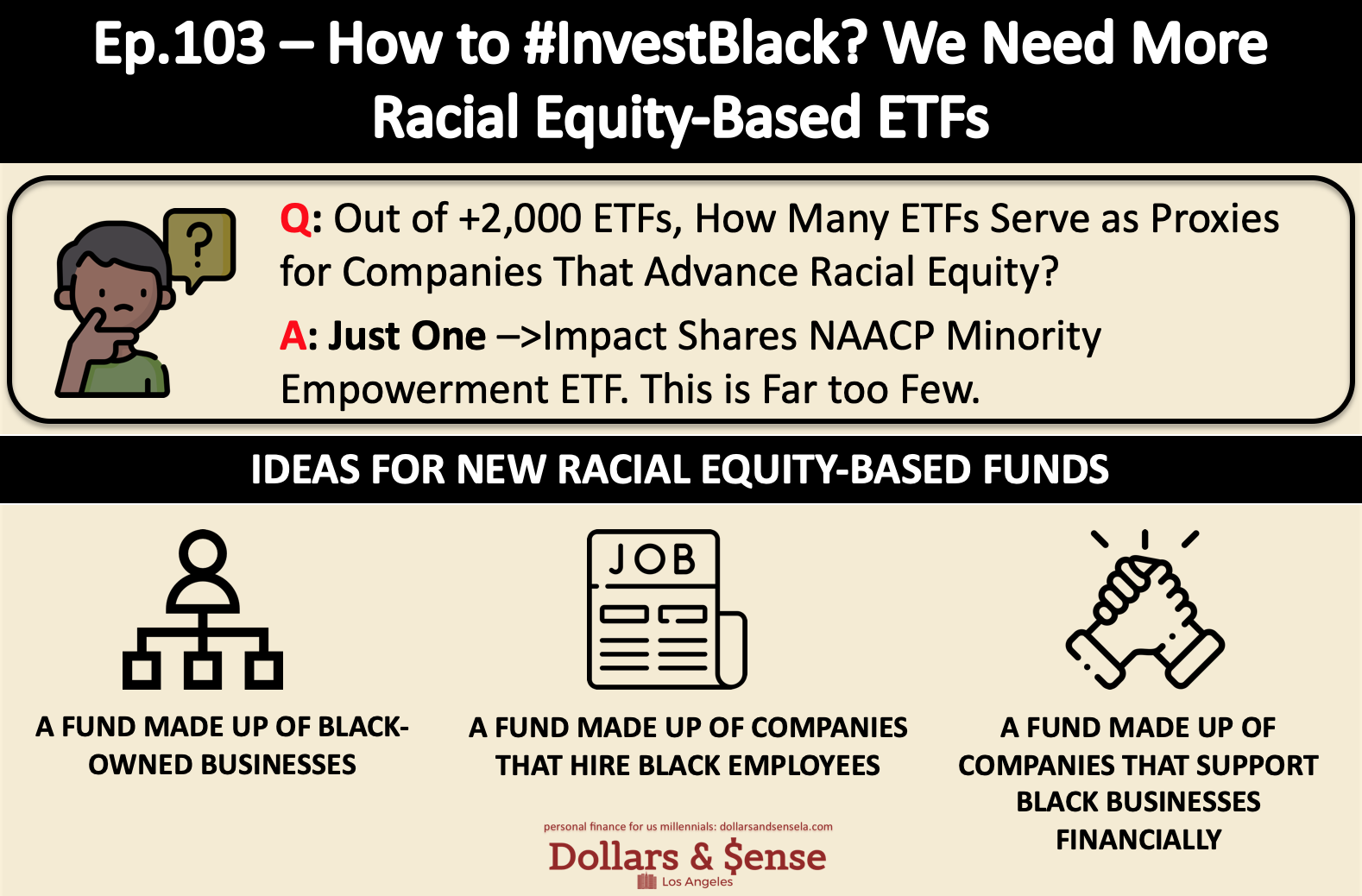

Ep.101. If you want to invest in companies that advance racial equity, your options are extremely limited right now. In fact, there is only 1 ETF out of +2000 out there that explicitly serves as a proxy for such companies. It’s just far too few. In order to allow the mass (whether you have $50 or $5,000) to financially support companies that advance racial equity in the right direction, there’s an opportunity to create more racial-equity based funds (ETFs), so people can easily understand, identify, and invest in them.

Read MoreEp.102. Have you wondered if you should pay off debt first, or start funding your 401k? This article offers a holistic framework, the Money Prioritization Pyramid, to help you manage money efficiently.

Read MoreEp.101. Apparently everyone is a day trader since Covid19. Yes. over 4.5 million new users registered for a brokerage account in the first quarter alone. Trading stocks involves risks. This article provides a simple 5-point guide on evaluating the risk levels in your stock picking.

Read MoreEp.100. In most major American cities, funding the police is the single biggest expense out of the General Fund, the primary budget source to run a city. Money reflects priority. Defunding the police is not only good economics, but it is also a public challenge to local officials, who have relied on largely symbolic gestures towards racial equity and justice, to take an actual stand and create a budget that truly says Black Lives Matter.

Read MoreEp.99. With the uncertainty in the job market, it could be a good time to see where you can cut spending in your budget. In my opinion, a smart goal would be cutting at least 10% of spending without causing the quality of life worse off by the same level. The three strategies I recommend are a) cutting things you don’t need, b) splitting costs on digital subscriptions, and c) taking advantage of low-interest rates.

Read MoreEp.98. In 2017, I was laid off and it was the worst experience for the whole year. Personally I went through 4 stages as I was processing what had happened. Today, over 23M Americans are unemployed and another 7M are out of the labor force. Many, if not most, are likely to share a similar layoff experience as I did. May you find comfort in this article.

Read MoreEp.97. I made a stock market prediction in Ep.92, believing the disappointing Q1 earnings season would trigger a market selloff. Ultimately, it turned out to be incorrect. I reflected deeply on this experience and summarized my post-mortem learnings into 3 key lessons.

Read MoreEp.96. During the Covid crisis, the Federal Reserve has created 10 facilities to pour trillions of dollars into the markets, in hopes of increasing market liquidity. You may have heard of terms like “Commerical Paper Funding Facility” or “Primary Dealer Credit Facility”. They sound more complicated than they are. This article will explain them in plain English.

Read MoreEp.95. Right now, the Federal Reserve is using the same playbook as it did back in 2008, because the core of the problem is the same, which is that money isn’t flowing through in the financial system. By examining the past, we can largely tell what the Federal Reserve will do next. This paper was written jointly by my classmates and me from Dartmouth College for my Econ 29 class back in 2011.

Read MoreEp.94. How to manage money in a looming recession, you ask? In my opinion, you should set value preservation (protect your hard-earned money), instead of rent-seeking (chasing high returns) as your primary goal. There are four actionable steps to help you achieve value preservation: seek job security, rebalance your 401k, beef up an emergency fund, and take calculated risks. However, out of all, you should make your job security as your number 1 priority, because no investment return can easily replace the salary of a full-time job.

Read MoreEp. 93. TIC (Tendency in Common) homes are popping up all over Los Angeles. When you buy one, you actually don’t own a home. Instead, you own a % share of in a multi-family complex. The “unit” you saw on Redfin will not have your name recorded on the deed, because there is only one deed for the entire complex as one entity, and all the units technically don’t exist from the eye of the county government.

Read MoreEp. 92. In the last week fo February 2020, stocks had the worst week since the 2008 recession, due to the fear of coronavirus spreading to the U.S. Based on my personal opinion, I think the stock market will go through 3 stages, leading to a selloff in April 2020, after the inevitably disappointing Q1 earnings results.

Read MoreEp. 91. A lot of my friends got married recently or are about to get married. I have been told that people believed marriage would save them on income taxes. Is this true? Well…. Marriage will save you on income taxes if the couple makes very different incomes. On the other hand, if they make the exact same wages, there are no savings at all. Follow me through the case studies to understand if marriage impacts your taxes or not.

Read MoreEp. 90. Tax season is here! Typically we believe that the more money we make, the higher the marginal tax is. What if I told you your marginal tax is actually lower at $150k than it is at $50k? This is true. As a single filer, your income taxes actually become lower between $133K and $173K, all because of how social security tax works.

Read MoreEp. 89. If you plan on leasing a car, you should absolutely use Rodo to gauge what a good deal for your specific car looks like in your area. After that, you can potentially get an even better deal by asking your local dealership to beat the best offer from Rodo.

Read MoreEp. 88. How I got $8,000 off on a brand new BMW. The key to getting a great deal on new cars is to directly speak to a fleet manager, aka an Internet manager, because he/she can apply the fleet discount, and he/she does not get paid on the final sales price.

Read MoreEp. 87. A detailed step-by-step guide on how to use Mint to track your spending effectively.

Read MoreEp. 86. Is your New Year’s resolution to improve your finances in 2020? If so, ask yourself the following 8 questions, as these questions will help you reflect, provide the advice and resources that can lead to concrete actions you can take.

Read MoreEp. 84. This is a story about how I serendipitously saved 60% on seat upgrades with Virgin Australia. Sometimes, there are special discounts that have not been written about on the Internet. It may just take a call to uncover it all.

Read MoreEp.84. It's time for health plan enrollment. A good health insurance plan has three major pillars. It fits your personal needs, provides excellent benefits, and it should be affordable. Here's a simple framework that can help you understand our health plan, thus making an informed decision.

Read More